.png)

New Insurance Agent Checklist: What to Do After Passing Your Exam?

Passed your exam? Use this new insurance agent checklist to avoid common delays and get licensed, appointed, and ready to sell faster.

.png)

Producer Onboarding Challenges That Quietly Delay Activation

Producer onboarding challenges rarely start as major problems. This guide explains how small visibility gaps turn into delays as agencies scale.

.png)

Why Medicare Licensing Takes Longer Than Expected?

Medicare licensing delays are rarely random. Learn the most common reasons approvals stall and why visibility matters more than speed.

.png)

How Independent Agents Avoid Missing Insurance License Renewals in 2026?

insurance license renewals are easy to miss without visibility. Learn how independent agents track renewals, CE, and deadlines to avoid compliance surprises.

.png)

Top 5 Medicare Agent Onboarding Challenges Slowing Agents Down

Medicare agent onboarding delays often come from small gaps teams miss. Discover the challenges that quietly stall activation and how InsureTrek fixes them

.png)

Non-Resident Insurance Licensing: A Practical Expansion Guide for 2026

Expanding to new states? This guide explains how non-resident insurance licenses work and how independent producers manage multi-state growth.

.png)

What Is NIPR and Why It Matters for Insurance Licensing?

Learn what NIPR is, how the National Insurance Producer Registry works, and why it plays a critical role in insurance licensing and compliance.

License Tracking for Insurance Agents: A Simple Guide for Independents

Learn how independent insurance agents track licenses, renewals, and CE, why manual methods fail, and how clearer visibility simplifies compliance.

.png)

Best AgentSync Alternative for Insurance Agencies in 2026

Looking for an AgentSync alternative? InsureTrek explains how agencies compare compliance platforms built for clarity and usability.

.png)

7 Reasons InsureTrek Is the Best Sircon Alternative in 2026

Discover 7 reasons growing insurance agencies choose InsureTrek as a Sircon alternative in 2026, with clearer license visibility and less operational friction.

.png)

Insurance CE Requirements Explained for Independent Agents (2026)

This guide explains insurance CE requirements, common compliance issues, and how independent agents manage CE across multiple states.

-1.png)

Medicare Agent Onboarding: The Ultimate Guide for Agencies in 2026

Medicare agent onboarding is complex and time-sensitive. Learn how agencies reduce delays, manage licensing, and get agents selling faster.

.png)

Insurance License Timeline: How Long Does It Take to Get Licensed by State?

Learn how the insurance license timeline works, what affects approval time, and why licensing can take days in some states and weeks in others.

Medicare License Steps: How to Get Licensed in 3 Easy Steps in 2026

Learn the Medicare license steps with InsureTrek. Understand the process, avoid licensing delays, and stay on track from application to approval.

.png)

Alaska State License Updates - January 2026

Alaska insurance license changes effective Jan 2026: Health LOA becomes Accident & Health or Sickness (935), multiple DRLPs permitted, system downtime Jan 8-9

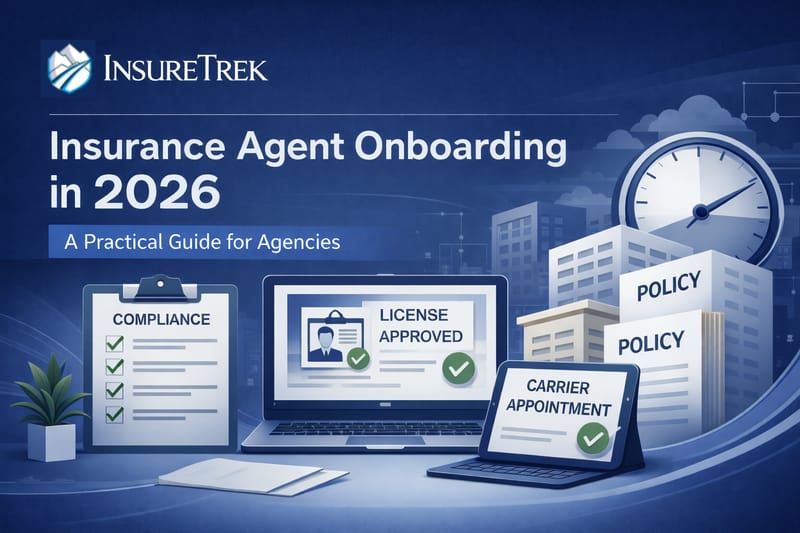

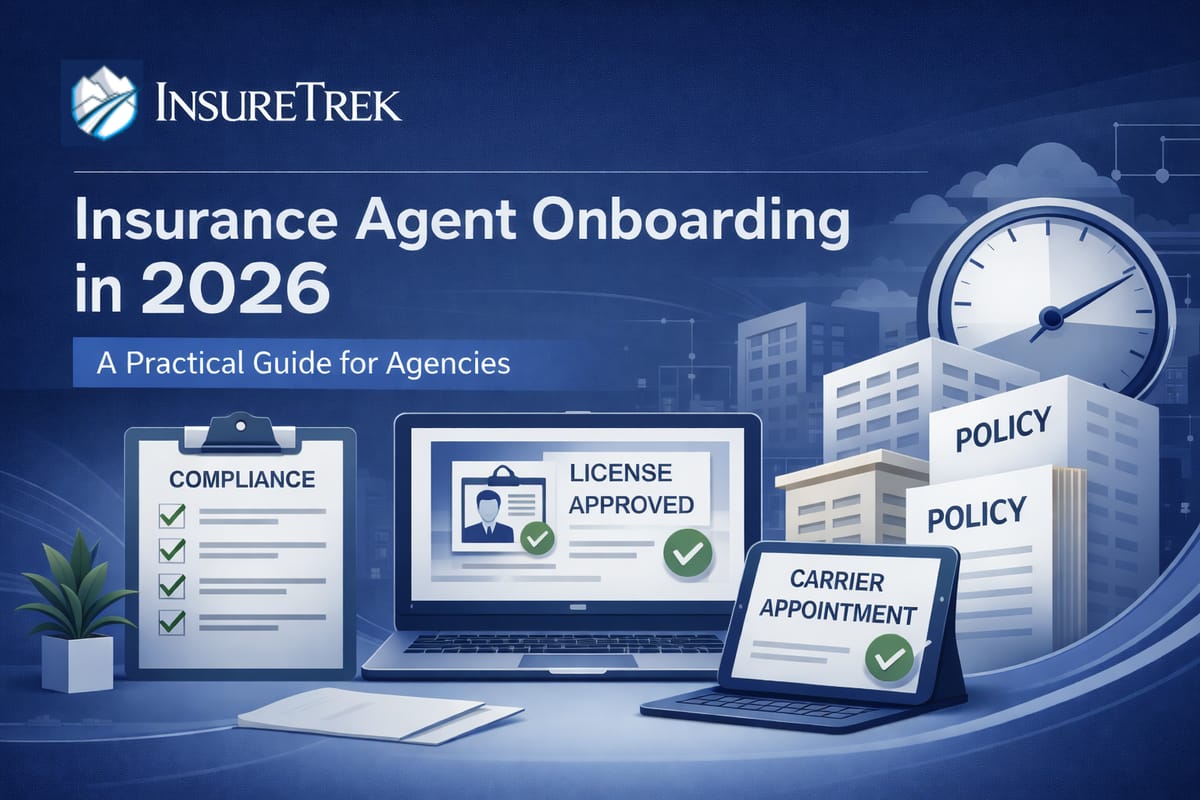

Insurance Agent Onboarding: A Practical, Compliance-First Guide for Agencies (2026)

Struggling with slow insurance agent onboarding? This guide breaks down licensing, carrier onboarding, and how InsureTrek help agencies reduce delays and compliance risk.

.png)

Lookup a Producer

Agency admins can now look up a producer's information without adding them to the team.

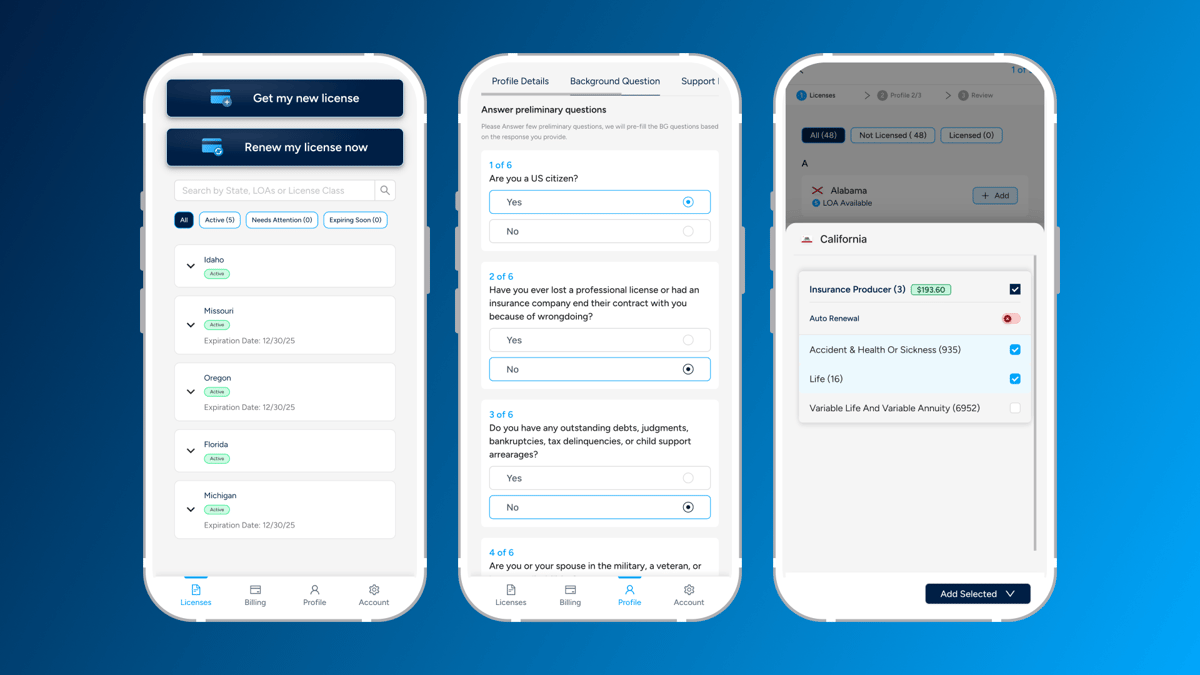

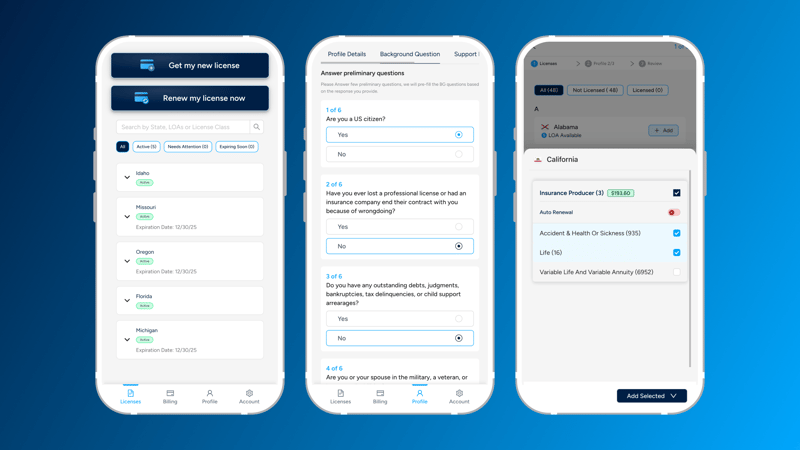

Introducing: InsureTrek Mobile

Independent Agents can now manage their licenses easier than ever with InsureTrek, available on the mobile web.

Lists Are Now Reports

We've updated our lists features to give you better insights.

QOL for License Management

Enhanced license overview for producers, better application controls, improved navigation, and important bug fixes.

Branch Agency Management

Branch agency support, interface improvements, bug fixes, and enhanced user experience updates throughout July 2025.

Weekly Reports and Enhanced Organizational Management

Automated weekly performance reports and improved organizational hierarchy management for upline agencies.

Enhanced Organizational Management

New hierarchy features and improved filtering experience for better organizational structure management.

A Few Quick Things

Small changes that add up - making InsureTrek easier to use with one-click answers, simplified assignments, and mobile improvements.

New Producer Home Page and Agency License Enhancements

Rebuilt producer home page with better organization and enhanced agency license functionality.

New Year Quality of Life Improvements

Bug fixes for individual producers and mobile optimization for the new year.

Bulk Onboarding Revamp and Year-End Improvements

Major improvements to bulk producer onboarding process and various quality-of-life enhancements.

Follow Ups for Manual Application Steps

New Follow Ups feature to track manual steps in applications, plus navigation and filtering improvements.

Unified License Management and Quick Filters

Combined license management into one screen with quick filters and enhanced List Builder functionality.

Agency Renewals and Email Improvements

Added agency license renewal functionality and improved email notifications and user experience.

License Amendments and Agency License Improvements

Introducing license amendments and cleaned up Agency Licenses screen for better management.

List Builder and Enhanced Reporting

New List Builder feature for filtering and exporting producer data, plus improved auto-renewal timing.

Enhanced Producer Management and New Features

Reworked Manage Producers screen with bulk operations, side panel details, and referral program introduction.

Improved Producer Management and Performance Enhancements

Reworked producer onboarding, cleaned up navigation, and significant performance improvements across the app.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

-1.png)

.png)

.png)

.png)